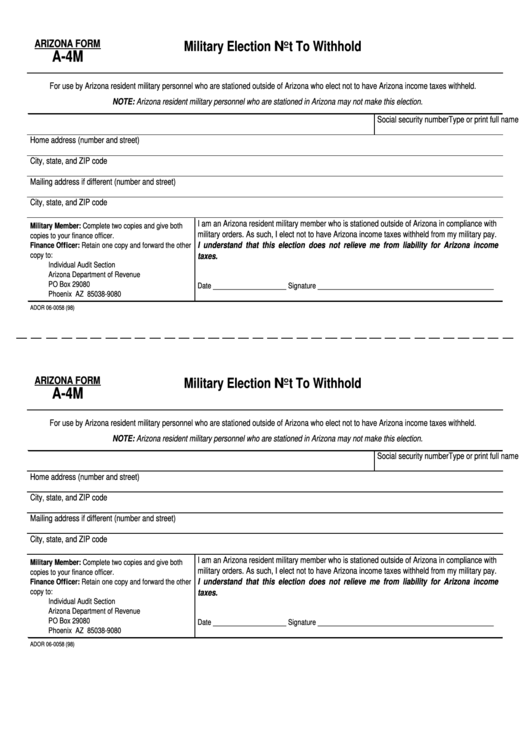

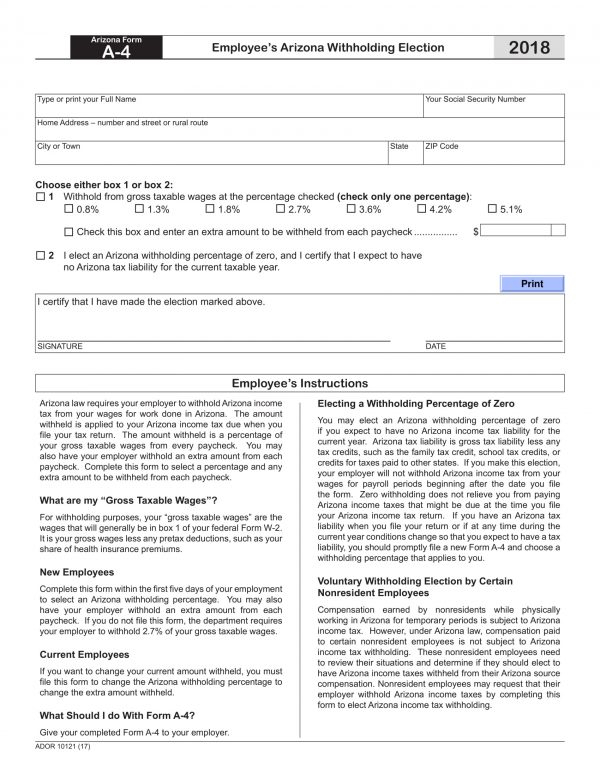

Arizona Form A4 How Much To Withhold

Arizona Form A4 is an important document for employers located in Arizona. This form is used to determine how much income tax must be withheld from the wages of employees. It is the employer's responsibility to ensure they are withholding the correct amount of taxes from their employees. Employers must also furnish this form to their employees.

Understanding Arizona Form A4

Arizona Form A4 is a withholding tax form that employers must submit to the Arizona Department of Revenue in order to determine the amount of income tax to be withheld from their employees’ wages. The form is used to calculate the amount of federal, state, and local taxes that must be deducted from the wages of employees. It also includes information about deductions and other tax-related information.

How to Complete Arizona Form A4

Completing Arizona Form A4 is a straightforward process. The form must be completed by the employer, who must provide the following information: the employer's name, address, and tax identification number; the employee's name, address, and Social Security number; the employee's marital status; the employee's wages and pay period; the number of allowances claimed; any additional withholding amounts; and any deductions taken. Once all of this information is provided, the employer can then calculate the total amount of taxes to be withheld from the employee's wages.

When to Submit Arizona Form A4

Employers must submit Arizona Form A4 to the Arizona Department of Revenue every quarter. This form must be submitted before the last day of the quarter, or else the employer may be subject to penalties and fines. Employers must also furnish this form to their employees and keep a copy of the form for their records.

What Happens if Arizona Form A4 is Not Filed?

If Arizona Form A4 is not filed, then an employer may be subject to penalties and fines from the Arizona Department of Revenue. Additionally, an employee's taxes may not be properly withheld, and they may be subject to paying additional taxes after filing their tax return.

Conclusion

Arizona Form A4 is an important document for employers located in Arizona. It is the employer’s responsibility to complete this form and submit it to the Arizona Department of Revenue in order to ensure that their employees’ taxes are properly withheld. Failure to submit this form can result in penalties and fines, and may also cause employees to owe additional taxes upon filing their tax returns.

What Is Form W-2? An Employer's Guide to the W-2 Tax Form | Gusto

FREE 11+ Employee Election Forms in PDF | MS Word

Top 5 A4 Form Templates free to download in PDF format