How To Fill Out It 2104 Form

Filling out IRS Form 2104 requires attention to detail and accuracy. Mistakes can delay your tax refund, so it’s important to take your time and double-check your information. This article will guide you through the process of accurately completing the form.

Gather Documentation

Before you can fill out Form 2104, you need to gather the necessary documents. This includes your W-2, 1099, and any other documents related to your income. Additionally, you’ll need your Social Security number, as well as the Social Security numbers of any dependents you’re claiming. Once you have all the documents and information you need, you can move on to filling out the form.

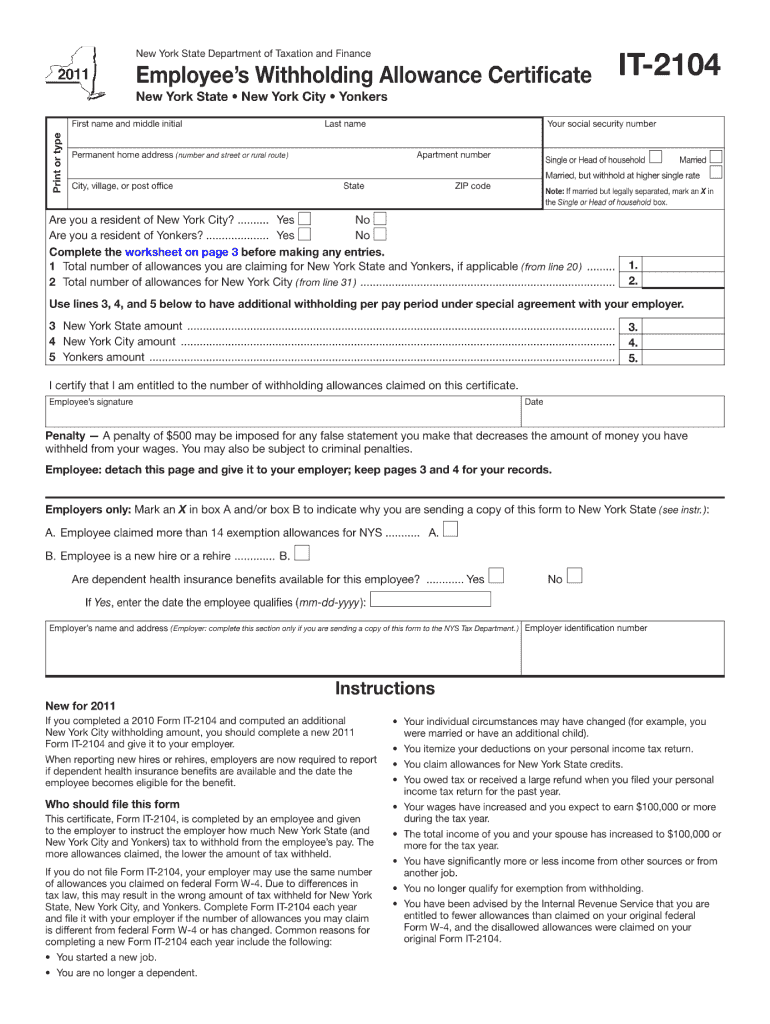

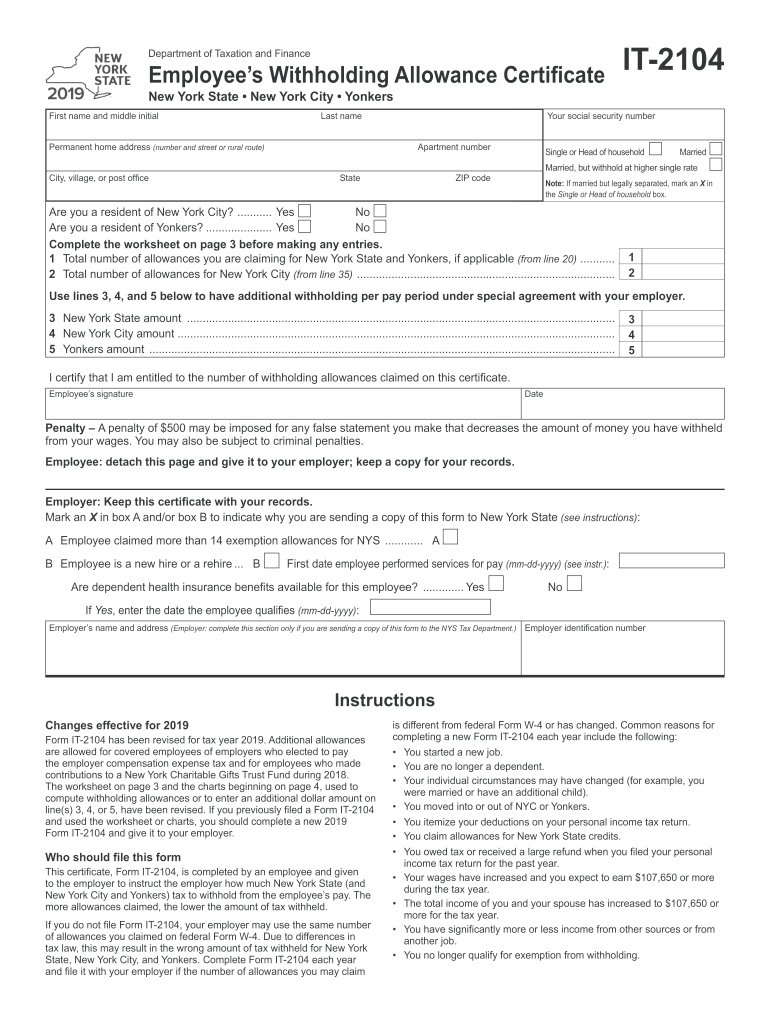

Understand the Form

Form 2104 is relatively straightforward, but it can still seem a bit overwhelming. Before you start filling out the form, take a few minutes to read over it and understand what is being asked. This will help ensure that you don’t make any mistakes. Additionally, you should read the instructions that come with the form, as they provide additional guidance on how to accurately complete the document.

Fill Out the Form

Once you’ve read the instructions and understand the form, you can start filling out the various sections. Begin by providing your name, address, and Social Security number. Then, you’ll need to enter all of your income, deductions, and other relevant information. Be sure to double-check your entries for accuracy. If you make a mistake, it can delay your tax refund, so accuracy is key.

Claim Dependents and Other Deductions

Form 2104 allows you to claim dependents and other deductions. If you’re claiming dependents, you’ll need to provide their Social Security numbers. Additionally, if you’re eligible for certain deductions, such as the Earned Income Tax Credit, you’ll need to provide the necessary documentation. Finally, if you’re filing jointly with a spouse, you’ll need to provide their Social Security number as well.

Sign the Form

Once you’ve filled out the form, you need to sign it. If you’re filing joint taxes, both you and your spouse must sign the form. Additionally, you’ll need to provide the date of signing. This is especially important if you’re filing taxes for a prior year, as the IRS may reject the form if it’s not signed within the specified time frame.

Submit the Form

Once you’ve signed the form, you’re ready to submit it to the IRS. You can mail the form, or you can submit it electronically. The method you choose will depend on your tax situation and the guidelines specified by the IRS. Regardless of which method you choose, make sure you keep a copy of the form for your records.

Conclusion

Filling out IRS Form 2104 can seem intimidating, but it doesn’t have to be. With the right guidance and attention to detail, you can quickly and accurately complete the form. Taking the time to gather all the necessary documents and double-check your work will ensure that your form is processed without any errors or delays.

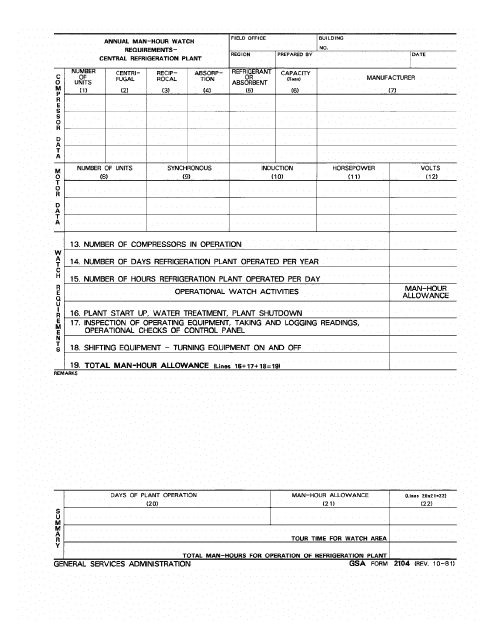

GSA Form 2104 Download Printable PDF or Fill Online Annual Man-Hour

2019 Form NY DTF IT-2104 Fill Online, Printable, Fillable, Blank

It 2104 Form - Fill Out and Sign Printable PDF Template | signNow